Intelligent Investing

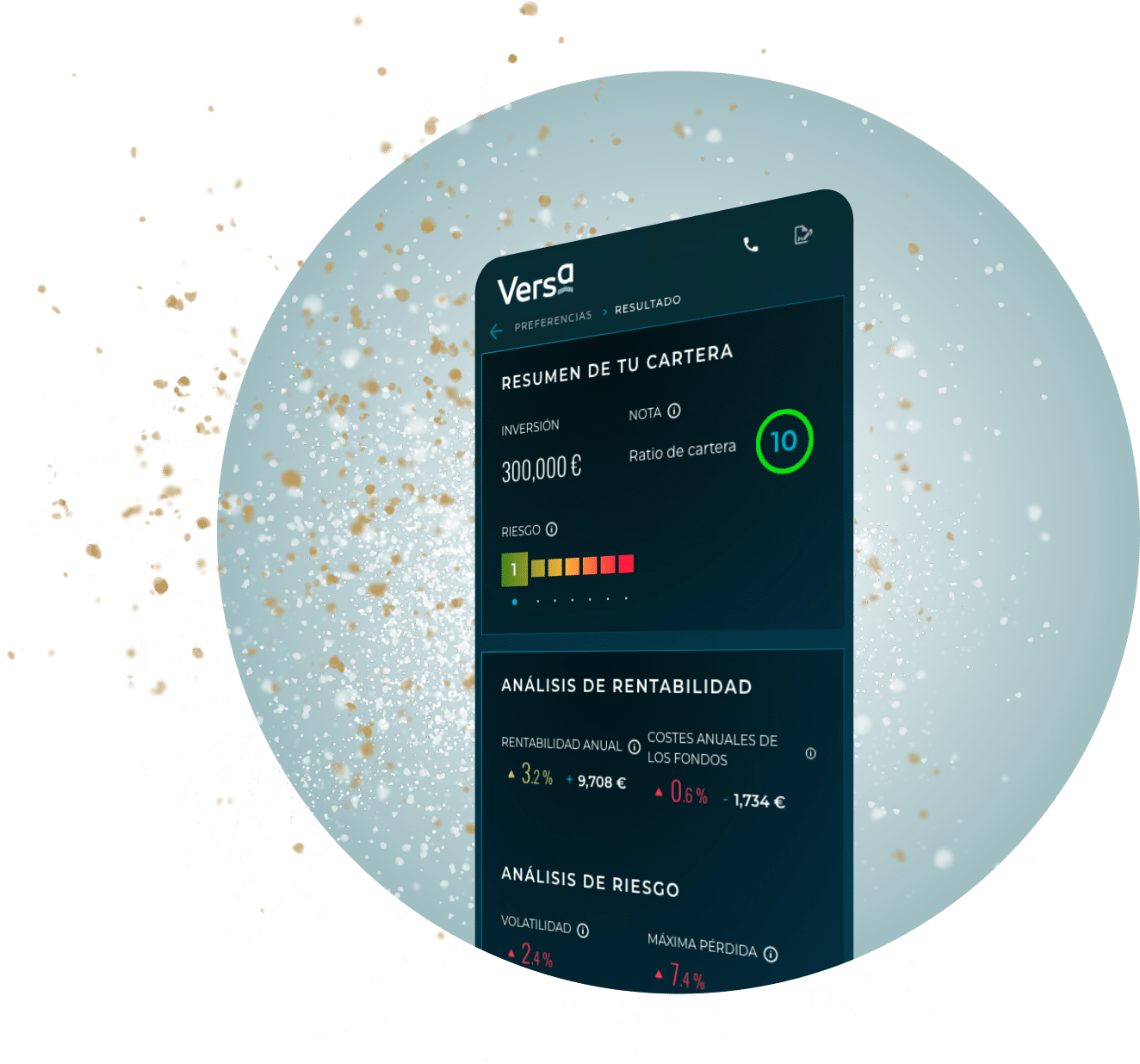

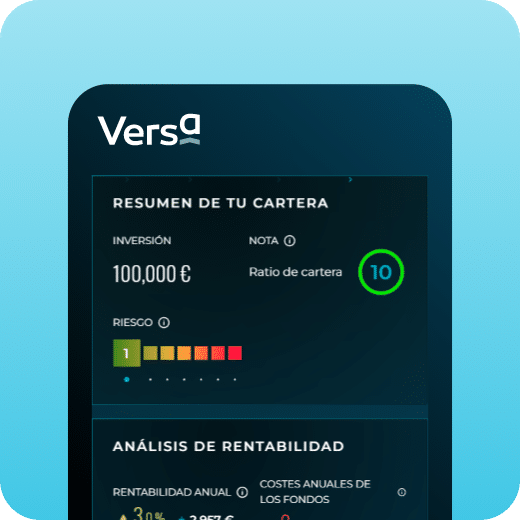

The first ever portfolio management service in which customers can analyse, compare and configure new portfolios through the fusion of the most advanced technology and the experience of our asset managers.

Diversify your Investment Fund portfolio – Come to VERSA and we will explain why

Strength

Part of the Miraltabank group, founded in 2011.

A securities company regulated and supervised by the CNMV.

Daily reviews

Portfolio aligned daily and not monthly, even to include or exclude funds and change risk profiles.

Diversification

Your funds are uncorrelated, which means a more diversified and complete portfolio.

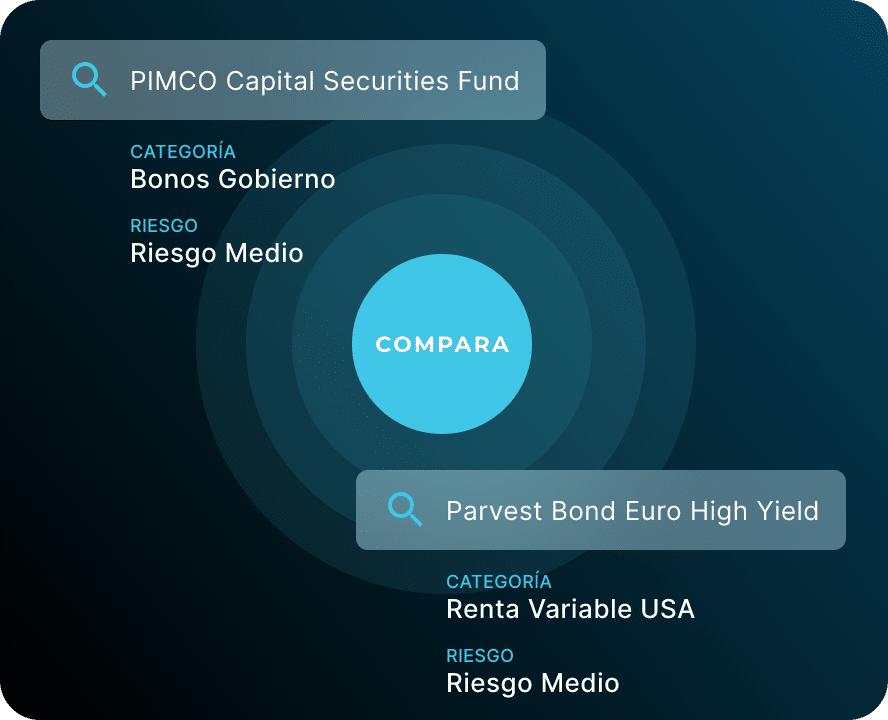

Open architecture

Possibility to access any fund from any international fund manager. We have a universe of 50,000 funds.

Clean Classes

Skip the intermediaries with us and save on third-party management commissions.

Independent character

We invest capital through our expertise and technology. We do not depend on third-party analysis or banks.

No obligation to stay

You can move in and out of your mutual fund portfolio whenever you want and without restrictions.

After-sales service

An unparalleled customer service that will answer all your questions and offer you the best investment opportunities.

Strength and flexibility for growth

Versa is the new way of understanding portfolio management. Versa brings together the latest technology, a selection of some of the best funds and a dedicated team of asset managers to help you invest better.

VERSA TEMPLATE PORTFOLIOS

View general information about VERSA – See the FAQs

Our technology gives you two options

In VERSA, you can either reconsider your current fund portfolio or create one from scratch and simulate your returns by adjusting diversification and risk.

Reconsider your current portfolio

Investment Diagnostics

Build your portfolio

Portfolio configurator

TYPES OF WALLETS ↓

VERSA Nº2 ↓

The Miraltabank Conservative portfolio suits investors who want slightly outperforming bonds with low equity exposure.

CUMULATIVE RETURN

PORTFOLIO DETAILS

- Launched on

- Currency

- Time horizon

- Currency

- Asset classes

- Benchmark index

- Management fee

- Deposit fee

- 31/12/2017

- Euro

- 2-4 años

- Euro

- Fondos de Inversión UCIT

- 25% EONIA + 60% RF + 15% RV

- 0,75%

- 0%

PERFORMANCE DATA

- Mes

- 2023

- 12 months

- 3 years (annualised)

- 5 years (annualised)

- 2022

- 2021

- 2020

- 2019

- 2018

- 2.44 %

- 5.1 %

- 4.22 %

- 0.04 %

- 1.46 %

- -7,58%

- 2,52%

- 3,15%

- 5,81%

- -3,69%

VERSA Nº3 ↓

Portfolio for investors who want returns linked to fixed income without giving up the diversification potential of equities or other assets.

CUMULATIVE RETURN

PORTFOLIO DETAILS

- Launched on

- Currency

- Time horizon recomendado

- Asset classes

- Benchmark index

- Management fee

- Deposit fee

- 31/12/2017

- Euro

- 2-4 años

- Fondos de Inversión UCIT

- 20% EONIA + 50% RF + 30% RV

- 0,75%

- 0%

PERFORMANCE DATA

- Mes

- 2023

- 12 months

- 3 years (annualised)

- 5 years (annualised)

- 2022

- 2021

- 2020

- 2019

- 2018

- 3.36 %

- 5.75 %

- 4.42 %

- 0.57 %

- 2.4 %

- -9,05%

- 4,79%

- 4,02%

- 9,55%

- -4,70%

VERSA Nº4 ↓

Portfolio for investors seeking diversified equity and bond exposure

CUMULATIVE RETURN

PORTFOLIO DETAILS

- Launched on

- Currency

- Time horizon recomendado

- Asset classes

- Benchmark index

- Management fee

- Deposit fee

- 31/12/2017

- Euro

- 3-4 años

- Fondos de Inversión UCIT

- 10% EONIA + 45% RF + 45% RV

- 0,75%

- 0%

PERFORMANCE DATA

- Mes

- 2023

- 12 months

- 3 years (annualised)

- 5 years (annualised)

- 2022

- 2021

- 2020

- 2019

- 2018

- 4.16 %

- 6.08 %

- 4.29 %

- 1.19 %

- 3.23 %

- -11,25%

- 8,48%

- 4,96%

- 13,22%

- -8,43%

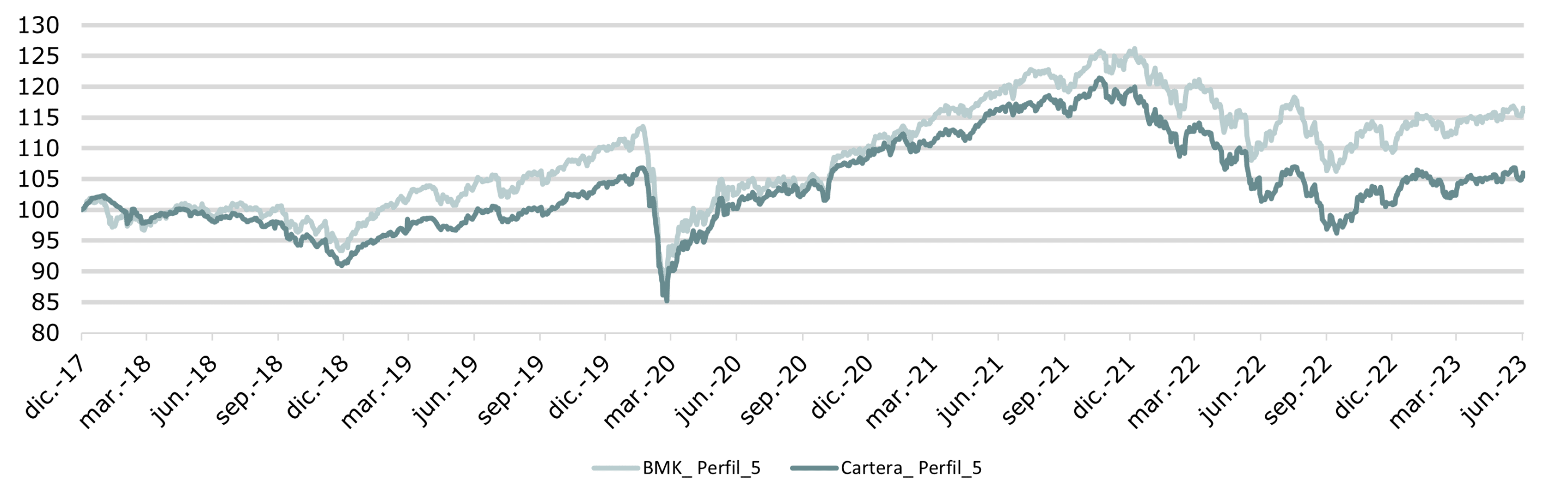

VERSA Nº5 ↓

Suitable portfolio for those investors who want exposure to equities, but without forgetting the diversification offered by fixed income.

CUMULATIVE RETURN

PORTFOLIO DETAILS

- Launched on

- Currency

- Time horizon recomendado

- Asset classes

- Benchmark index

- Management fee

- Deposit fee

- 31/12/2017

- Euro

- +5 años

- Fondos de Inversión UCIT

- 5% EONIA + 35% RF + 60% RV

- 0,75%

- 0%

PERFORMANCE DATA

- Mes

- 2023

- 12 months

- 3 years (annualised)

- 5 years (annualised)

- 2022

- 2021

- 2020

- 2019

- 2018

- 5.22 %

- 7.23 %

- 4.97 %

- 0.26 %

- 2.66 %

- -15,60%

- 9,76%

- 4,96%

- 13,22%

- -8,43%

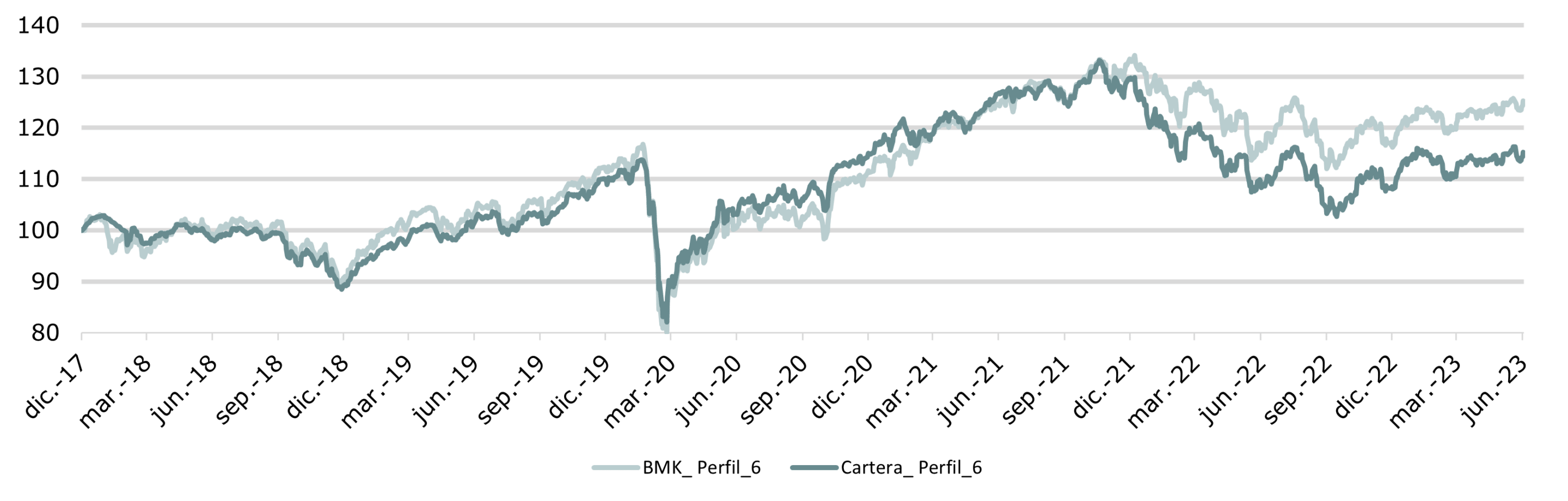

VERSA Nº6 ↓

Portfolio for investors seeking a majority equity exposure with a high-risk tolerance

CUMULATIVE RETURN

PORTFOLIO DETAILS

- Launched on

- Currency

- Time horizon recomendado

- Asset classes

- Benchmark index

- Management fee

- Deposit fee

- 31/12/2017

- Euro

- +5 años

- Fondos de Inversión UCIT

- 5% EONIA + 20% RF + 75% RV

- 0,95%

- 0%

PERFORMANCE DATA

- Mes

- 2023

- 12 months

- 3 years (annualised)

- 5 years (annualised)

- 2022

- 2021

- 2020

- 2019

- 2018

- 6.49 %

- 9.21 %

- 6.12 %

- 1.52 %

- 4.5 %

- -16,60%

- 12,72%

- 5,50%

- 21,65%

- -10,51%

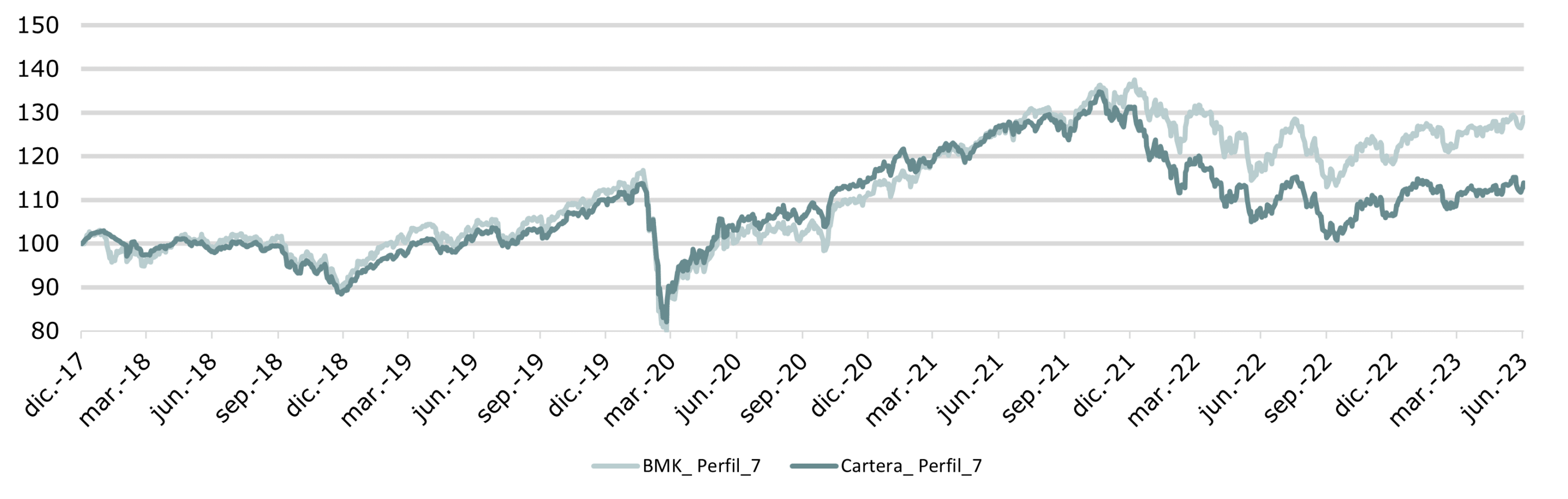

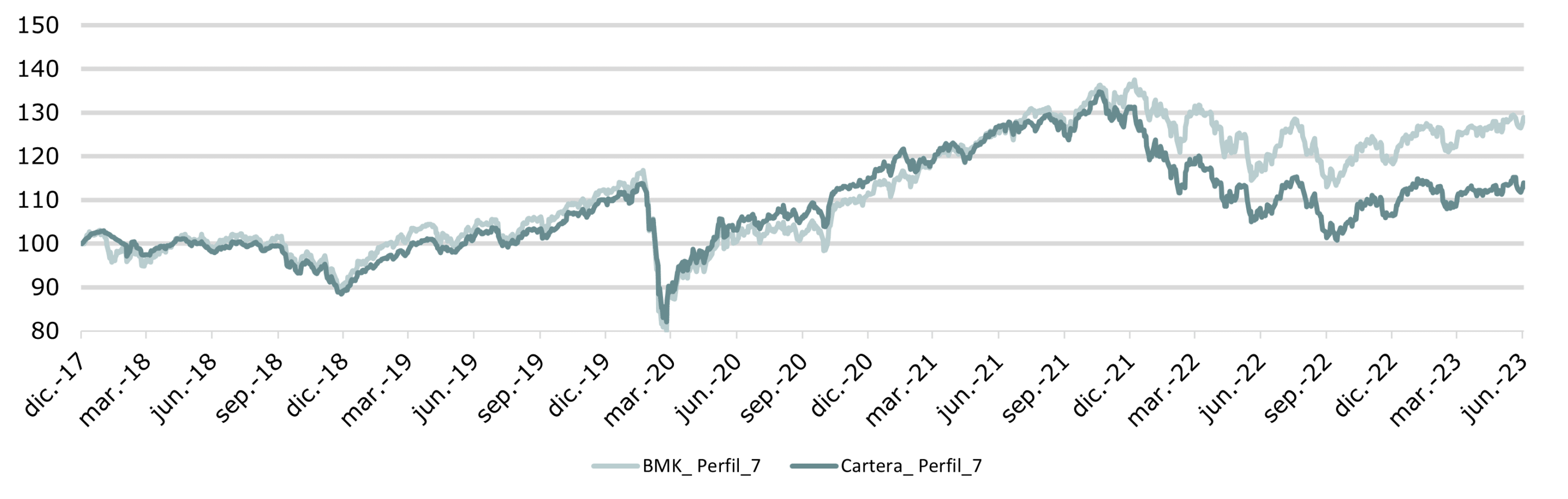

VERSA Nº7 ↓

Portfolio for investors seeking a majority equity exposure with a high-risk tolerance.

CUMULATIVE RETURN

PORTFOLIO DETAILS

- Launched on

- Currency

- Time horizon recomendado

- Asset classes

- Benchmark index

- Management fee

- Deposit fee

- 31/12/2017

- Euro

- +5 años

- Fondos de Inversión UCIT

- 5% EONIA + 5% RF + 90% RV

- 0,95%

- 0%

PERFORMANCE DATA

- Mes

- 2023

- 12 months

- 3 years (annualised)

- 5 years (annualised)

- 2022

- 2021

- 2020

- 2019

- 2018

- 7.39 %

- 9.87 %

- 6.26 %

- 1.2 %

- 4.31 %

- -18,82%

- 14,03%

- 5,50%

- 21,65%

- -10,51%

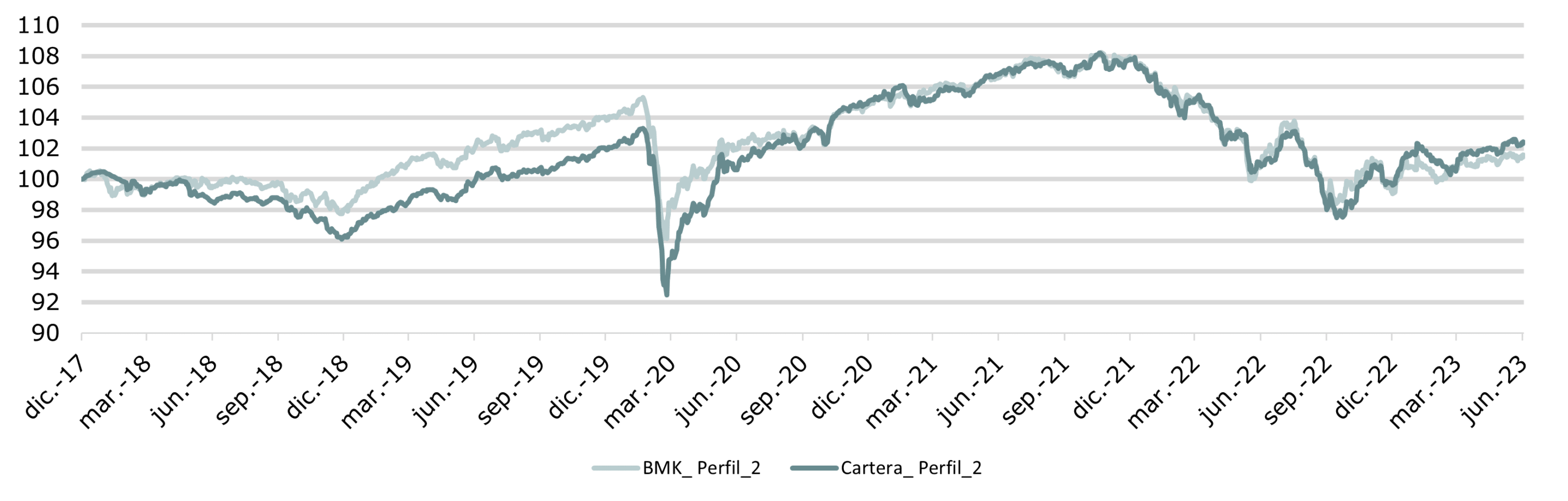

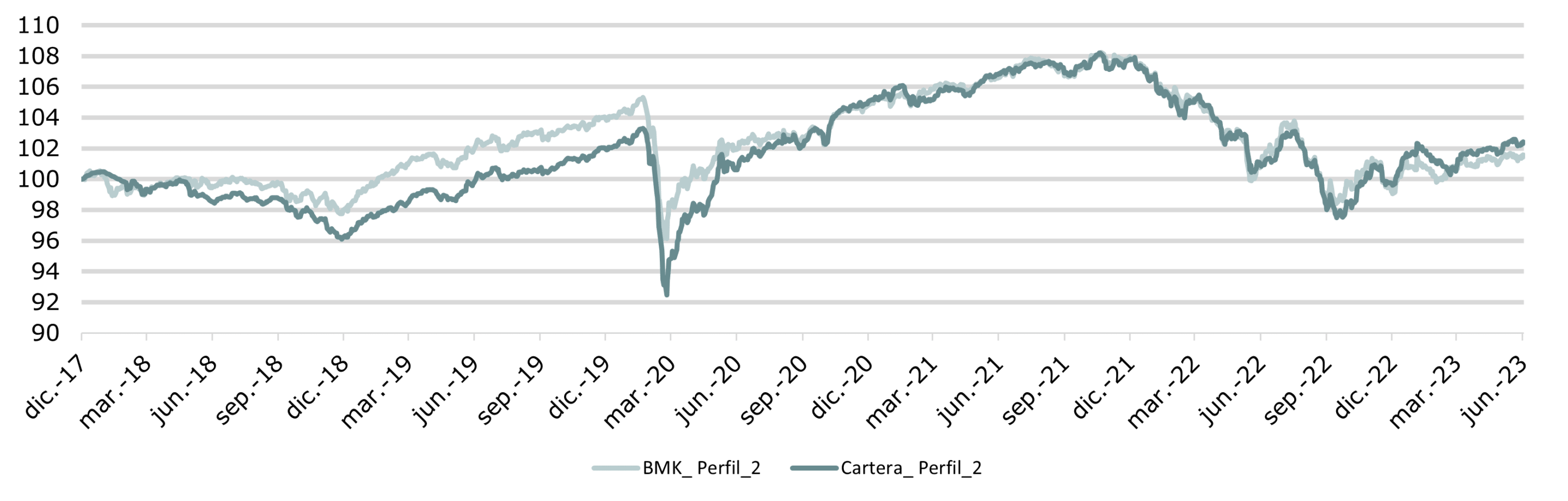

The profitability expressed refers to simulated historical results for the period from 12/29/14 to 12/31/17. The vertical line drawn on the charts marks the beginning of the portfolio management service. The results between 01/01/18 and 09/30/2022 correspond to the conservative portfolio and reference index (25% EONIA +60% RF + 15% RV) of the contract in force in said period

Data as of closing date of 06/30/2023. Source: Miraltabank. The profitability expressed is gross, with commissions and other applicable expenses being 0.75%. Past performance is not a reliable indicator of future results.

La rentabilidad expresada hace referencia a resultados históricos simulados para el periodo comprendido entre el 29/12/14 hasta el 31/12/17. La línea vertical dibujada en los gráficos marca el inicio del servicio de gestión de carteras. Los resultados comprendidos entre 01/01/18 y 31/05/2022 corresponden a la cartera conservadora e índice de referencia (25% EONIA +60% RF + 15% RV) del contrato vigente en dicho periodo.

Datos a cierre de 28/02/2023. Fuente: Miraltabank. La rentabilidad expresada es bruta, siendo las comisiones y otros gastos aplicables del 0,75%. Los rendimientos pasados no constituyen un indicador fiable de resultados futuros.

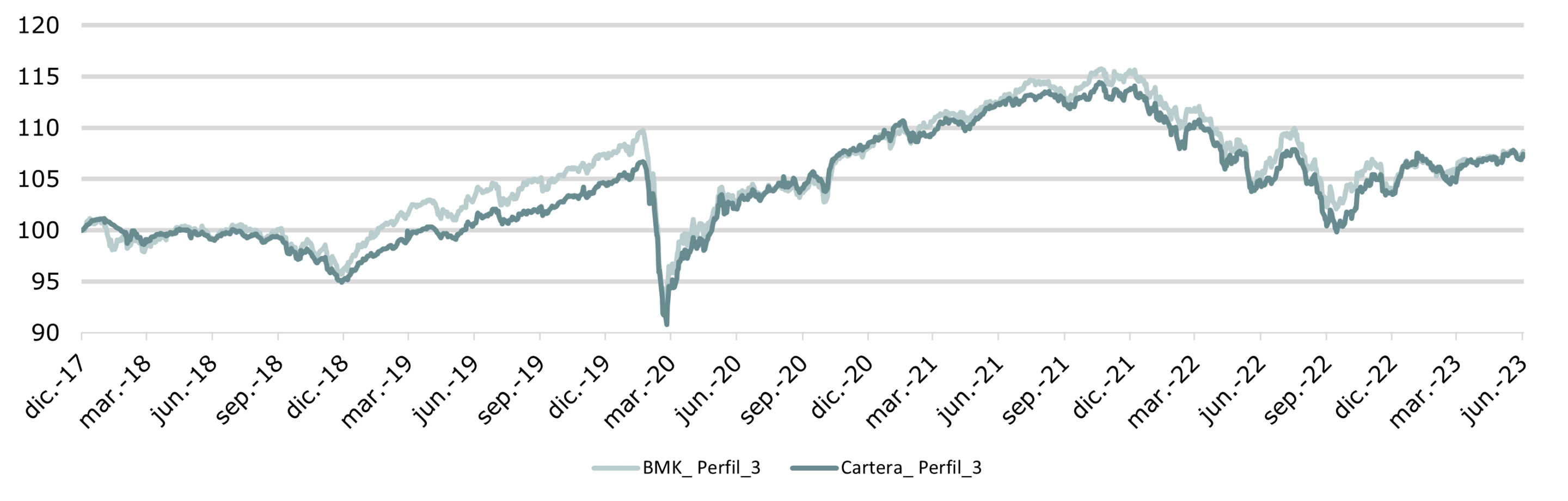

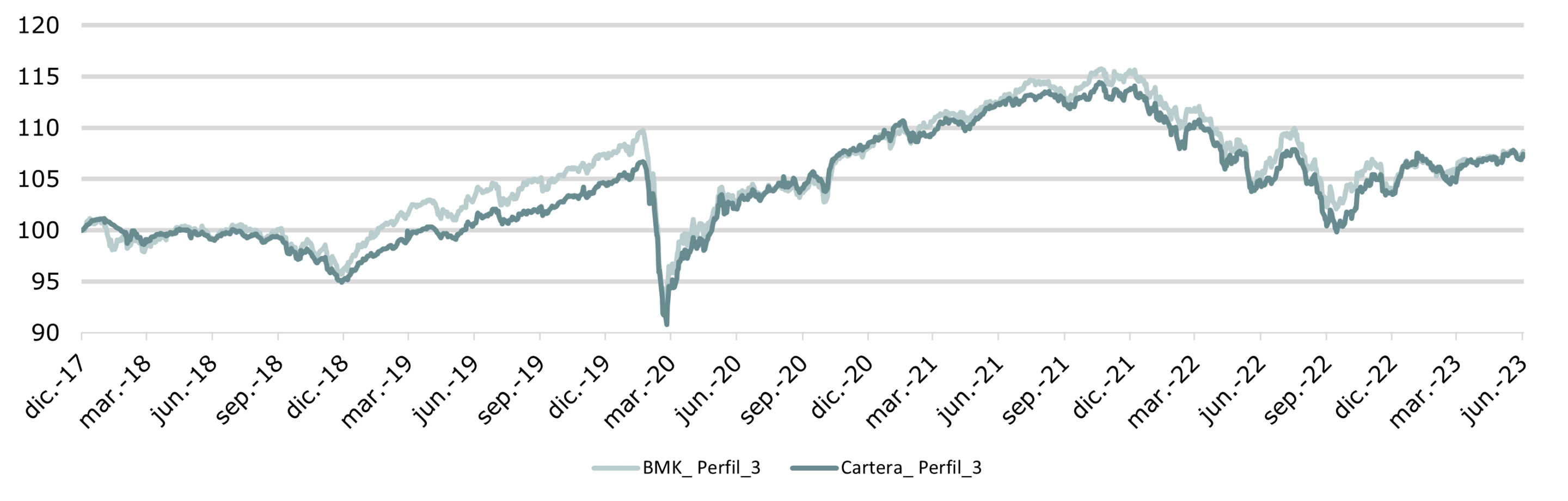

La rentabilidad expresada hace referencia a resultados históricos simulados para el periodo comprendido entre el 29/12/14 hasta el 31/12/17. La línea vertical dibujada en los gráficos marca el inicio del servicio de gestión de carteras. Los resultados comprendidos entre 01/01/18 y 31/05/22 corresponden a la cartera conservadora e índice de referencia (20% EONIA + 50% RF + 30% RV) del contrato vigente en dicho periodo

Datos a cierre de 28/02/2023. Fuente: Miraltabank. La rentabilidad expresada es bruta, siendo las comisiones y otros gastos aplicables del 0,75%. Los rendimientos pasados no constituyen un indicador fiable de resultados futuros.

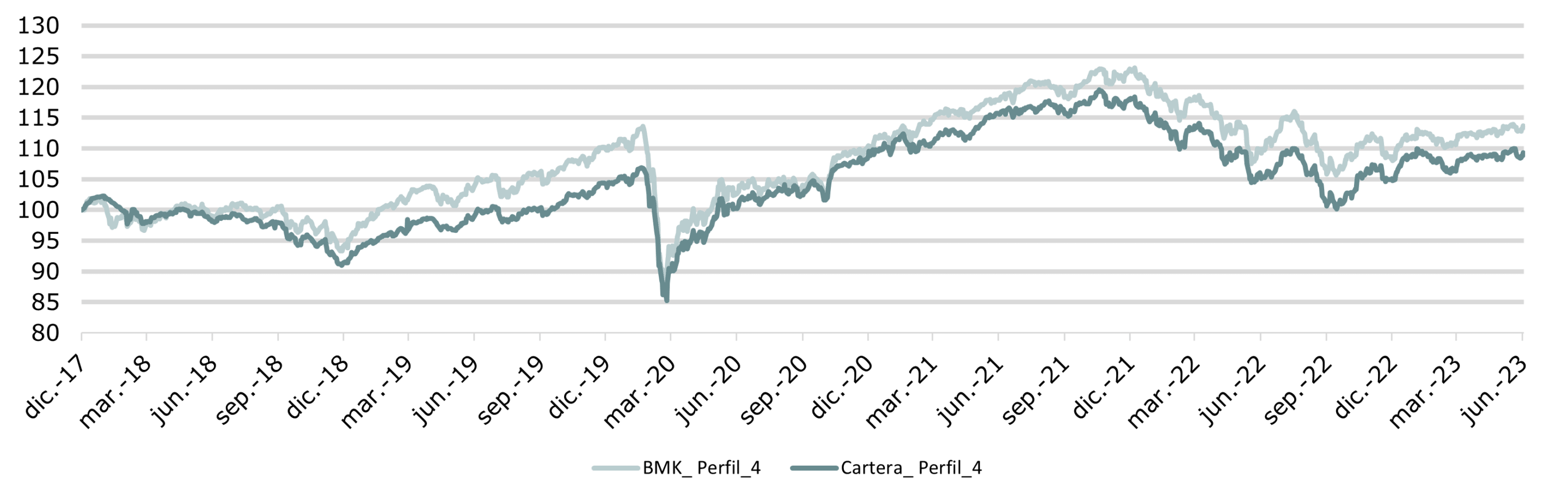

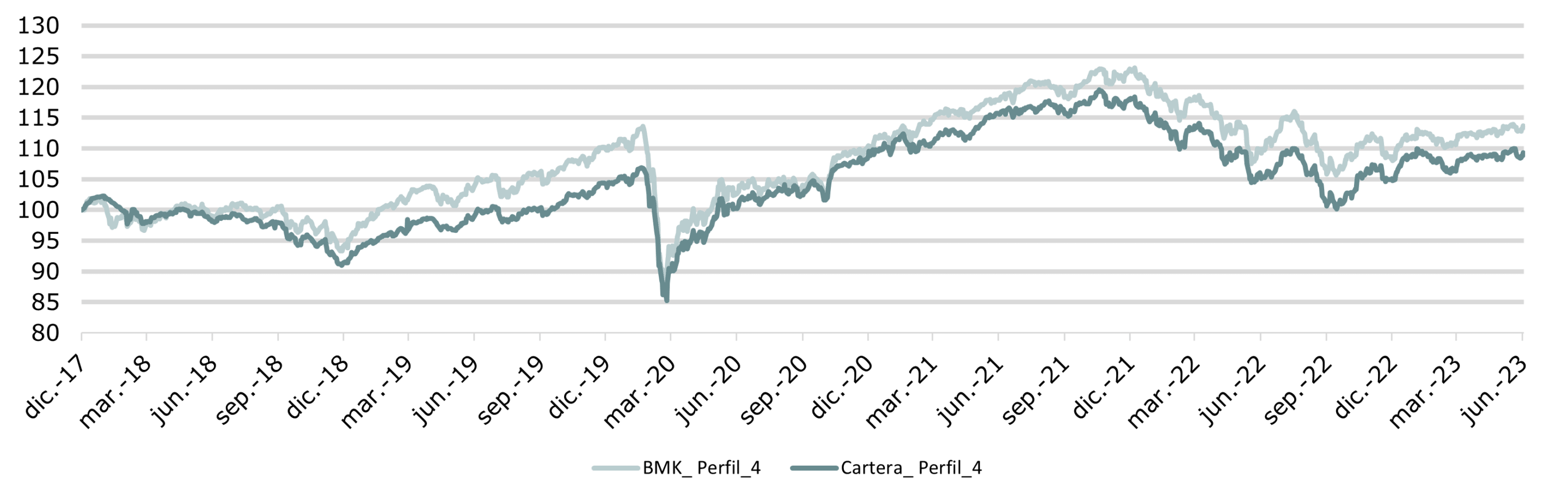

La rentabilidad expresada hace referencia a resultados históricos simulados para el periodo comprendido entre el 29/12/14 hasta el 31/12/17. La línea vertical dibujada en los gráficos marca el inicio del servicio de gestión de carteras. Los resultados comprendidos entre 01/01/18 y 31/05/2022 corresponden a la cartera conservadora e índice de referencia (10% EONIA + 45% RF + 45% RV) del contrato vigente en dicho periodo.

Datos a cierre de 28/02/2023. Fuente: Miraltabank. La rentabilidad expresada es bruta, siendo las comisiones y otros gastos aplicables del 0,75%. Los rendimientos pasados no constituyen un indicador fiable de resultados futuros.

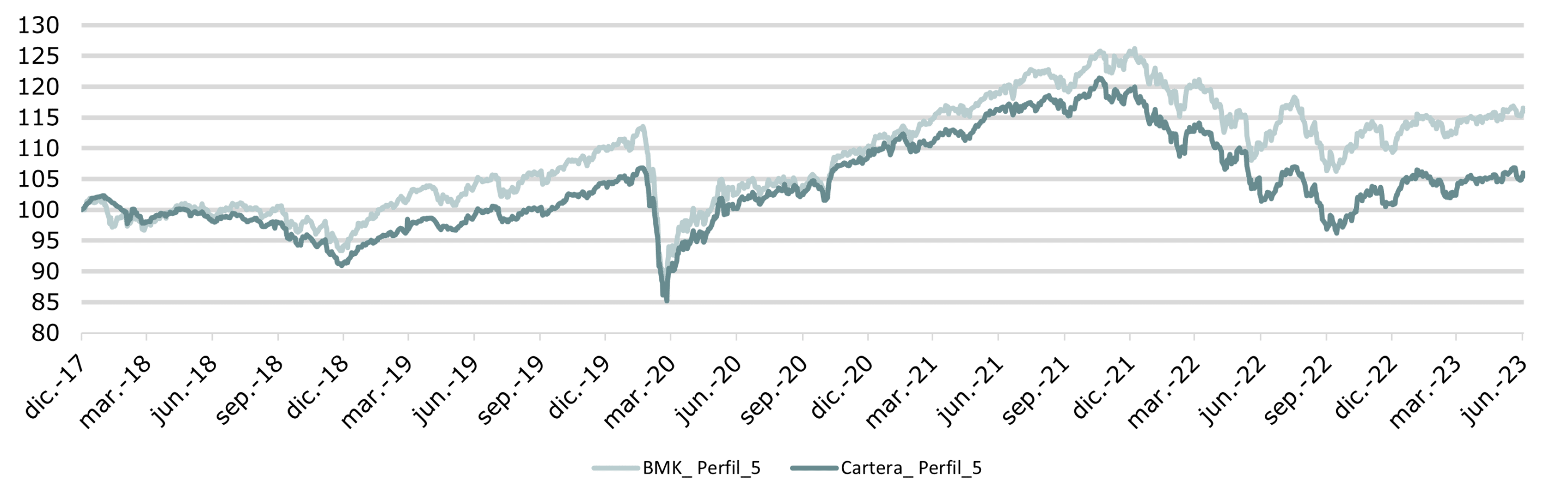

La rentabilidad expresada hace referencia a resultados históricos simulados para el periodo comprendido entre el 29/12/14 hasta el 31/12/17. La línea vertical dibujada en los gráficos marca el inicio del servicio de gestión de carteras. Los resultados comprendidos entre 01/01/18 y 31/05/22 corresponden a la cartera conservadora e índice de referencia (5% EONIA + 35% RF + 60% RV) del contrato vigente en dicho periodo.

Datos a cierre de 28/02/2023. Fuente: Miraltabank. La rentabilidad expresada es bruta, siendo las comisiones y otros gastos aplicables del 0,75%. Los rendimientos pasados no constituyen un indicador fiable de resultados futuros.

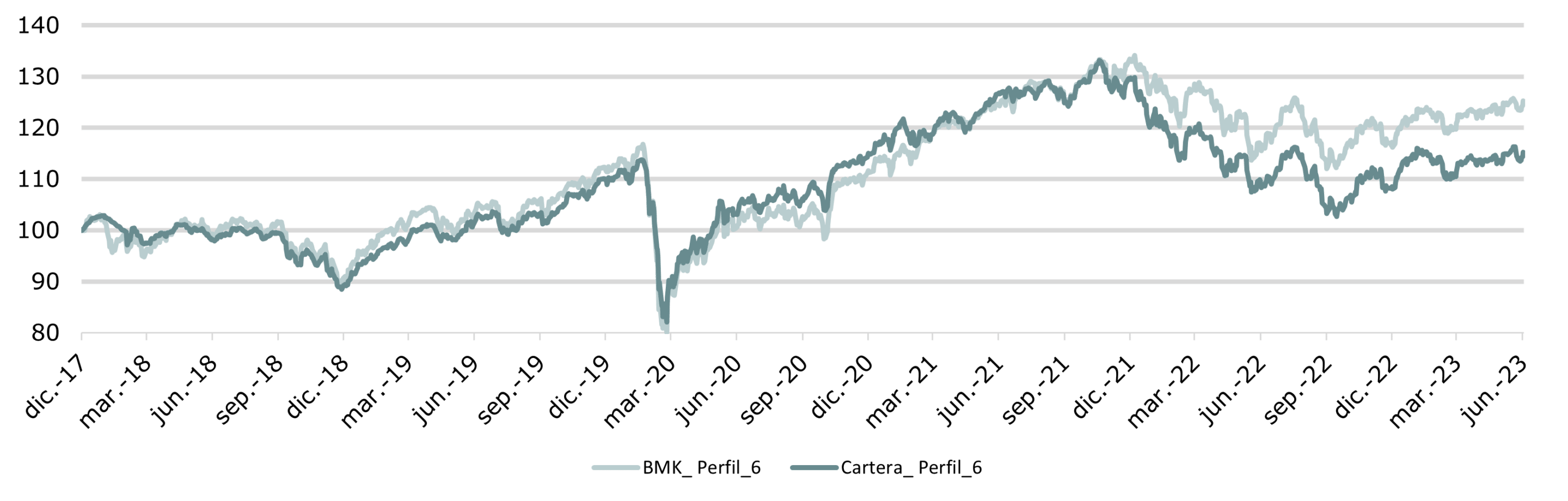

La rentabilidad expresada hace referencia a resultados históricos simulados para el periodo comprendido entre el 29/12/14 hasta el 31/12/17. La línea vertical dibujada en los gráficos marca el inicio del servicio de gestión de carteras. Los resultados comprendidos entre 01/01/18 y 31/05/22 corresponden a la cartera conservadora e índice de referencia (5% EONIA + 20% RF + 75% RV) del contrato vigente en dicho periodo.

Datos a cierre de 28/02/2023. Fuente: Miraltabank. La rentabilidad expresada es bruta, siendo las comisiones y otros gastos aplicables del 0,95%. Los rendimientos pasados no constituyen un indicador fiable de resultados futuros.

La rentabilidad expresada hace referencia a resultados históricos simulados para el periodo comprendido entre el 29/12/14 hasta el 31/12/17. La línea vertical dibujada en los gráficos marca el inicio del servicio de gestión de carteras. Los resultados comprendidos entre 01/01/18 y 31/05/22 corresponden a la cartera conservadora e índice de referencia (5% EONIA + 5% RF + 90% RV) del contrato vigente en dicho periodo.

Datos a cierre de 28/02/2023. Fuente: Miraltabank. La rentabilidad expresada es bruta, siendo las comisiones y otros gastos aplicables del 0,95%. Los rendimientos pasados no constituyen un indicador fiable de resultados futuros.

PROFILE Nº2 ↓

The Miraltabank Conservative portfolio suits investors who want slightly outperforming bonds with low equity exposure.

CUMULATIVE RETURN

PORTFOLIO DETAILS

- Launched on

- Currency

- Time horizon

- Asset classes

- Benchmark index

- Management fee

- Deposit fee

- 31/12/2017

- Euro

- 2-4 años

- Fondos de Inversión UCIT

- 25% EONIA + 60% RF + 15% RV

- 0,75%

- 0%

PERFORMANCE DATA

- Month

- 2023

- 12 months

- 3 years (annualised)

- 5 years (annualised)

- 2022

- 2021

- 2020

- 2019

- 2018

- 2.44 %

- 5.1 %

- 4.22 %

- 0.04 %

- 1.46 %

- -7,58%

- 2,52%

- 3,15%

- 5,81%

- -3,69%

DOCUMENTATION

- Presentación Narval FI

- Folleto completo

- Folleto clase A

- lorem lorem lorem ipsu

- lore sir amet dolorew

- Datos fundamentales para el inversor clase G

- Cuentas anuales 2019

- Informe semestral 1S 2020

- lorem ipsum doloer 3

- lorem ipsum doloer

PROFILE Nº3 ↓

Portfolio for investors who want returns linked to fixed income without giving up the diversification potential of equities or other assets.

CUMULATIVE RETURN

PORTFOLIO DETAILS

- Launched on

- Currency

- Time horizon

- Asset classes

- Benchmark index

- Management fee

- Deposit fee

- 31/12/2017

- Euro

- 2-4 años

- Fondos de Inversión UCIT

- 20% EONIA + 50% RF + 30% RV

- 0,75%

- 0%

PERFORMANCE DATA

- Month

- 2023

- 12 months

- 3 years (annualised)

- 5 years (annualised)

- 2022

- 2021

- 2020

- 2019

- 2018

- 3.36 %

- 5.75 %

- 4.42 %

- 0.57 %

- 2.4 %

- -9,05%

- 4,79

- 4,02%

- 9,55%

- -4,70%

DOCUMENTATION

- Presentación Narval FI

- Folleto completo

- Folleto clase A

- lorem lorem lorem ipsu

- lore sir amet dolorew

- Datos fundamentales para el inversor clase G

- Cuentas anuales 2019

- Informe semestral 1S 2020

- lorem ipsum doloer 3

- lorem ipsum doloer

Portfolio for investors seeking diversified equity and bond exposure

CUMULATIVE RETURN

PORTFOLIO DETAILS

- Launched on

- Currency

- Time horizon

- Asset classes

- Benchmark index

- Management fee

- Deposit fee

- 31/12/2017

- Euro

- 3-4 años

- Fondos de Inversión UCIT

- 10% EONIA + 45% RF + 45% RV

- 0,75%

- 0%

PERFORMANCE DATA

- Month

- 2023

- 12 months

- 3 years (annualised)

- 5 years (annualised)

- 2022

- 2021

- 2020

- 2019

- 2018

- 4.16 %

- 6.08 %

- 4.29 %

- 1.19 %

- 3.23 %

- -11,25%

- 8,48%

- 4,963%

- 13,22%

- -8,43%

DOCUMENTATION

- Presentación Narval FI

- Folleto completo

- Folleto clase A

- lorem lorem lorem ipsu

- lore sir amet dolorew

- Datos fundamentales para el inversor clase G

- Cuentas anuales 2019

- Informe semestral 1S 2020

- lorem ipsum doloer 3

- lorem ipsum doloer

Suitable portfolio for those investors who want exposure to equities, but without forgetting the diversification offered by fixed income.

CUMULATIVE RETURN

PORTFOLIO DETAILS

- Launched on

- Currency

- Time horizon

- Asset classes

- Benchmark index

- Management fee

- Deposit fee

- 31/12/2017

- Euro

- +5 años

- Fondos de Inversión UCIT

- 5% EONIA + 35% RF + 60% RV

- 0,75%

- 0%

PERFORMANCE DATA

- Month

- 2023

- 12 months

- 3 years (annualised)

- 5 years (annualised)

- 2022

- 2021

- 2020

- 2019

- 2018

- 5.22 %

- 7.23 %

- 4.97 %

- 0.26 %

- 2.66 %

- -15,60%

- 9,76%

- 4,96%

- 13,22%

- -8,43%

DOCUMENTATION

- Presentación Narval FI

- Folleto completo

- Folleto clase A

- lorem lorem lorem ipsu

- lore sir amet dolorew

- Datos fundamentales para el inversor clase G

- Cuentas anuales 2019

- Informe semestral 1S 2020

- lorem ipsum doloer 3

- lorem ipsum doloer

Portfolio for investors seeking a majority equity exposure with a high-risk tolerance

CUMULATIVE RETURN

PORTFOLIO DETAILS

- Launched on

- Currency

- Time horizon

- Asset classes

- Benchmark index

- Management fee

- Deposit fee

- 31/12/2017

- Euro

- +5 años

- Fondos de Inversión UCIT

- 5% EONIA + 20% RF + 75% RV

- 0,95%

- 0%

PERFORMANCE DATA

- Month

- 2023

- 12 months

- 3 years (annualised)

- 5 years (annualised)

- 2022

- 2021

- 2020

- 2019

- 2018

- 6.49 %

- 9.21 %

- 6.12 %

- 1.52 %

- 4.5 %

- -16,60%

- 12,72%

- 5,50%

- 21,65%

- -10,51%

DOCUMENTATION

- Presentación Narval FI

- Folleto completo

- Folleto clase A

- lorem lorem lorem ipsu

- lore sir amet dolorew

- Datos fundamentales para el inversor clase G

- Cuentas anuales 2019

- Informe semestral 1S 2020

- lorem ipsum doloer 3

- lorem ipsum doloer

Portfolio for investors seeking a majority equity exposure with a high-risk tolerance.

CUMULATIVE RETURN

PORTFOLIO DETAILS

- Launched on

- Currency

- Time horizon

- Asset classes

- Benchmark index

- Management fee

- Deposit fee

- 31/12/2017

- Euro

- +5 años

- Fondos de Inversión UCIT

- 5% EONIA + 5% RF + 90% RV

- 0,95%

- 0%

PERFORMANCE DATA

- Month

- 2023

- 12 months

- 3 years (annualised)

- 5 years (annualised)

- 2022

- 2021

- 2020

- 2019

- 2018

- 7.39 %

- 9.87 %

- 6.26 %

- 1.2 %

- 4.31 %

- -18,82%

- 14,03%

- 5,50%

- 21,65%

- -10,51%

DOCUMENTATION

- Presentación Narval FI

- Folleto completo

- Folleto clase A

- lorem lorem lorem ipsu

- lore sir amet dolorew

- Datos fundamentales para el inversor clase G

- Cuentas anuales 2019

- Informe semestral 1S 2020

- lorem ipsum doloer 3

- lorem ipsum doloer

How does VERSA work?

Filtering

The fund data are discriminated and prepared to make them comparable and the rest of the processes more accurate and efficient on the main adverse sustainability impacts.

Clustering

Cluster funds into opportunities to encourage diversification and cost reduction.

Ranking

Opportunities are ordered from best to worst according to criteria determined by the management team and with complete independence.

Risk analysis

Allocation of weighting according to long-term and short-term risk.

What is portfolio management?

Portfolio management is a financial investment service for us to design different combinations of financial assets, shares and funds, among others, to create a personalised investment portfolio according to the investor’s preferences and needs.

Our portfolio management service combines the most innovative artificial intelligence technology with the experience of expert asset managers to deliver a track record of high returns.

This combination of technology and human expertise facilitates the achievement of long-term investment goals while also enabling the creation of robust, specialised portfolios similar to those of large investors but without the need to invest large amounts of capital.

We combine the most innovative technology with human capital

Investment simulator

Solid and exclusive portfolios

No obligations or restrictions

Do you have any questions?

We put a team of advisors at your disposal to help you with whatever you need.

OTHER PRODUCTS THAT YOU MIGHT BE INTERESTED IN ↓

Miraltabank

Capital market

Information

We provide trading and execution services to a wide range of institutional clients: investment funds, banks, hedge funds, family offices, agencies and broker-dealers.

Miraltabank

Advice

Information

We offer investment advisory and risk management services to a wide range of institutional customers.