NARVAL EUROPA

A unique fund in an ocean of investments

Every investor has their own investment objectives, but they all have the same goal of protecting their wealth and increasing their equity.

Our equity fund aims to grow its investors’ capital at a faster rate than the stock markets over the long term. We invest in leading European multinational companies to benefit from global growth and development. We seek value in great companies. Regardless of the sector in which they operate, Narval Europe invests in companies with a strong culture of innovation so that, as long-term investors, we place our capital in companies capable of creating their own future.

Benefit from long-term strategies with Miralta Narval Europe. Outperform the indices with maximum risk containment.

CLASE A

COST EFFECTIVENESS ↓

21.26 %Performance since inception

133.663379€

Net asset value* as at2023-11-29

0.08%

Daily valuation

- YTD

- 2022

- 2021

- 2020

- 2019

- 2018

- 16.56%

- -11.29%

- 12.70%

- 16.73%

- 8.12%

- -11.27%

DETAILS OF THE FUND ↓

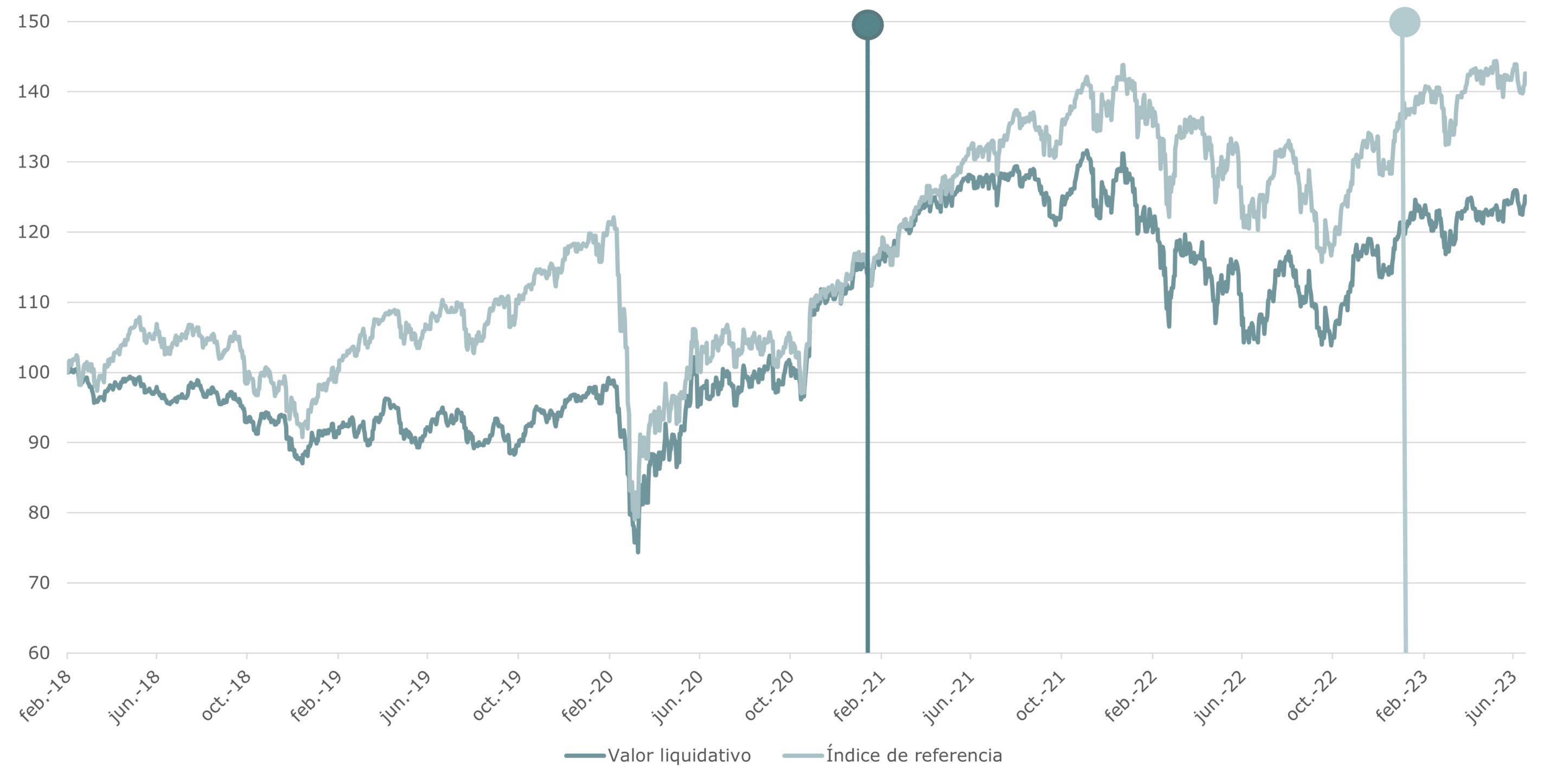

EVOLUTION OF THE NET ASSET VALUE

HISTORIC class A FUND – Data as at close of business 28/02/2023. Source: Miraltabank.

From 23/12/2022: Change in Class A management fees (1.20%/9% success) and change in benchmark index to MSCI Europe.

From 02/11/2020: Class A data valid until 23/12/22 with management fee of 1.60%, and benchmark Stoxx600 TR.

Before 02/11/2020: Class A data valid until 02/11/20 with management fee of 1.10% and Stoxx600 TR benchmark”

Managers’ comments

During the first days of June, consensus was achieved regarding the debt ceiling in the United States, which prevented default by the US government. In the eurozone, the highlight was the reduction in the inflation rate, which stood at 5.5%, while the underlying inflation rate rose to 5.4%. This could lead to additional interest rate hikes by the European Central Bank (ECB). Thus, the United Kingdom central bank (BoE) has been forced to raise rates by 50bp more after the worrying inflation data in the region (8.7% in May).

The optimism generated by artificial intelligence and a labor market that remains stable for the moment have boosted the markets in June. The MSCI EUROPE index had a return of +2.24% in the month, while Miralta Narval Europe performed better, +3.29% in class F, due to its exposure to the United States. Basically, during the month we have slightly increased exposure to the industrial, financial and healthcare sectors.

GENERAL DETAILS

- CNMV Registration No

- ISN Code

- Launched on

- Currency

- Type of assets

- Benchmark index

- Management fee

- Deposit fee

- Minimum investment

- Auditor

- 5200

- ES0173367048

- 22/11/2020

- Euro

- Monetario, renta variable, gestión

- STOXX Europe 600 Net Return

- 1,20% / 9% éxito

- 0,10% /0,075%

- 100 €

- Deloitte

CLASS A DETAILS

- Net asset value* as at 2023-11-29

- Variation of the net asset value as at 2023-11-29

- Fund assets as at 2023-11-29

- BASIC RETURNS

- 1 day

- YTD

- 1 month

- Since inception

- 133.663379€

- 0.08%

- 7,591,675.73€

- 0.08%

- 16.56%

- 5.86%

- 21.26%

Documentation

(*): The net asset value and other informative documents of the funds available on this website are published in compliance with article 18.2 of the Law on Collective Investment Undertakings under the responsibility of Miralta Asset Management SGIIC, S.A.U., which is responsible for updating and maintaining them.

Data as at EOB 28/02/2023. Source: Miraltabank. The return expressed above is net of fees and expenses. Past return is not a reliable indicator of future results.

Track record Narwhal ↓

European Large Cap Equity Fund

• Rating 5 stars in category: EV Europa Large Blend February 2023

• Rating 5 stars in category: EV Europa Large Blend January 2023

• 5-star rating in category: EV Europa Large Blend during 2022

Our pillars ↓

• Financial Method

• Sustainable Investment

• Active Management

I’D LIKE MORE INFORMATION ↓

Personal information

OTHER PRODUCTS THAT MAY INTEREST YOU ↓

MiraltaBank

Sequoia

Information

Our fixed-income fund, based on a tacit approach to the markets. More flexibility and diversification.

More information

MiraltaBank

Pulsar I

Information

Our hedge fund (HF), a solution to the complex fixed-income investment scenario

More information

MiraltaBank

Pulsar II

Information

New free investment fund (FIL) designed as a strategic solution for both investors and companies.

More information