Sequoia Fixed Income

Strength and flexibility

for growth.

With a global and flexible approach, our fixed-income fund aims primarily to maximise returns while ensuring minimum risk and volatility. We develop an active strategy and risk management to benefit from interest rate and credit curve term structure inefficiencies. Our investment process employs innovative technology to enhance the cognitive capabilities of our global macro approach. Its prospectus is flexible enough to address multiple scenarios in the fixed income universe and OECD countries, both corporate and government, while maintaining a flexible duration (0-10 years), which can even be negative. Sequoia promotes sustainability through its own ESG criteria, excluding certain sectors, companies and countries whose stocks do not meet these criteria.

CLASS A

COST EFFECTIVENESS ↓

8.73 %Returns since inception

108.879769€

Net asset value* as at 2023-12-06

0.4 %

Daily valuation

- YTD

- 2022

- 2021

- 2020

- 2019

- 2018

- 7.88%

- -4.95%

- 0.49%

- 8.60%

- 2.48%

- - 4.89%

DETAILS OF THE FUND ↓

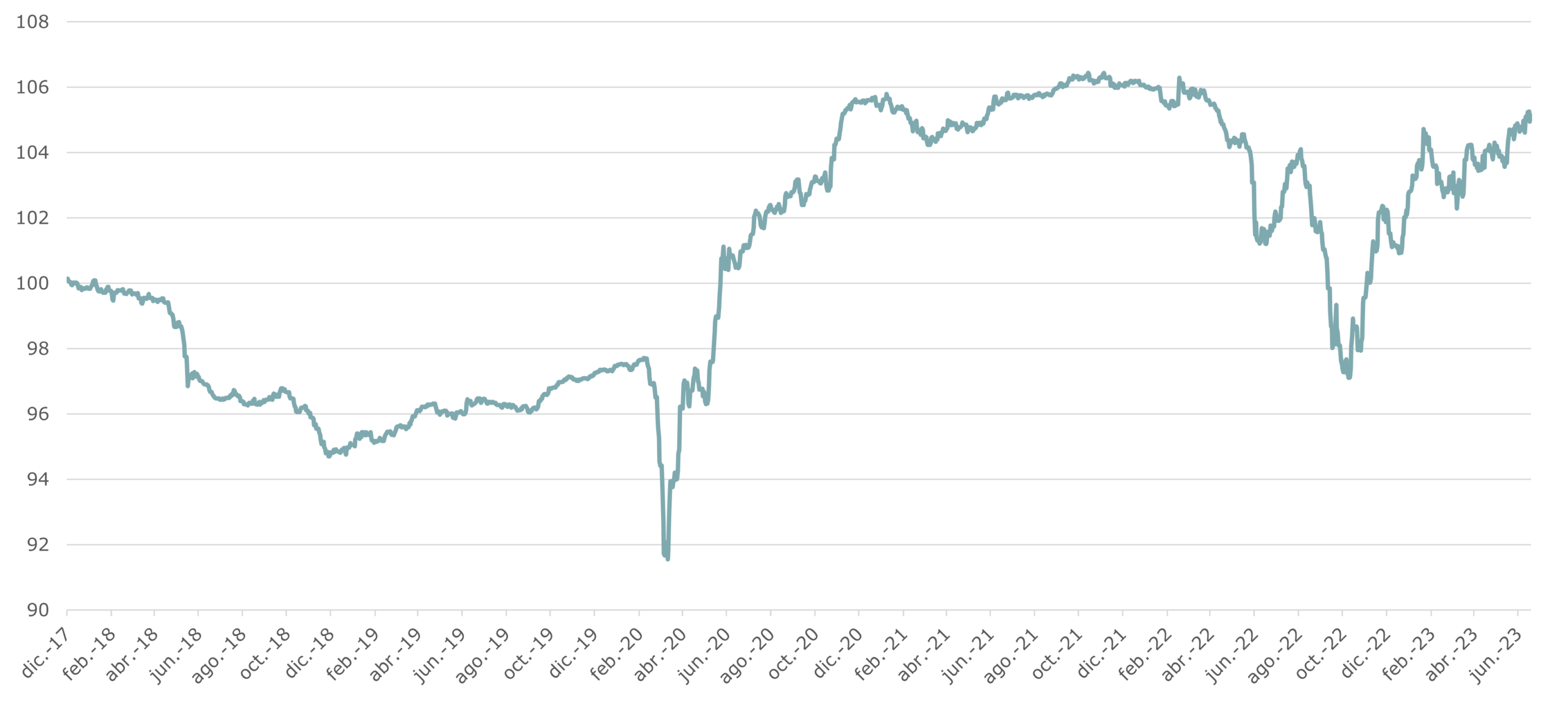

EVOLUTION OF THE NET ASSET VALUE

*Data correct as: 30/06/2023

Comments of the asset managers

During the month of June we have seen a significant drop in fixed income volatility levels, despite the slight decline in bond prices. Activity data from the European Union have confirmed its entry into recession. Without a doubt, the greatest tensions from a macro point of view are found in the United Kingdom, where inflation readings continue to surprise, which is forcing the BoE to tighten monetary policy. We have taken advantage of the latest rate increase to take short-term exposure above 5%. We have slightly increased exposure to convertibles by purchasing Siemens Energy 2-year bonds, following the sharp declines in the stock, which gave us the opportunity to purchase optionality at very advantageous prices. We continue to maintain a large liquidity cushion, greater than 15%, which will allow us to face the coming months with an opportunistic nature.

GENERAL INFORMATION

- GENERAL INFORMATION

- ISN Code

- Launched on

- Currency

- Asset class

- Management fee

- Deposit fee

- Minimum investment

- Depositary

- Auditor

- 5209

- ES0173368004

- 26/10/2017

- Euro

- Monetario, renta fija, gestion

- 1,05% / 7% éxito

- 0,10% / 0,075%

- 1 participación

- Caceis Bank Spain, S.A

- Deloitte

CLASS A DETAILS

- Net asset value* as at 2023-12-06

- Variation of the net asset value as at 2023-12-06

- Fund assets as at 2023 2023-12-06

- BASIC RETURNS

- 1 day

- YTD

- 1 month

- Since inception

- 108.879769

- 0.4%

- 96,739,375.66€

- 0.4%

- 7.88%

- 1.38%

- 8.73%

Documentation

Sustainability

General

A class

Class B

Class C

Class E

Class F

G Class

(*): The net asset value and other informative documents of the funds available on this website are published in compliance with article 18.2 of the Law on Collective Investment Undertakings under the responsibility of Miralta Asset Management SGIIC, S.A.U., which is responsible for updating and maintaining them.

Data as at EOB 28/02/2023. Source: Miraltabank. The return expressed above is net of fees and expenses. Past return is not a reliable indicator of future results.

Track record Sequoia ↓

• Expansion | Best Long-Term Fixed Income fund. Awards 2023

• Morningstar | Best fund 3 and 5 years RF Diversified EUR

• VDOS | Rating 5 stars RFI GLOBAL

• Funds People Rating | 2023

• Morningstar | Top 5 2022 Diversified RF EUR

• Morningstar | Top 5 2021 Diversified RF EUR

• Morningstar | Best fund 2020 RF Diversified EUR

• Better Sharpe ratio at 3 and 5 years

Track record manager ↓

• Citywire – Ignacio Fuertes | Best Fixed Income Manager – Euro 2022

• Citywire – Top 2 managers of 2000 in March. 2023

• Citywire – Top 3 managers of 2000 in Feb. 2023

Partner. Investment Director. Member of the Investment Committee

I’D LIKE MORE INFORMATION ↓

Personal information

OTROS PRODUCTOS QUE TE PUEDEN INTERESAR ↓

OTHER PRODUCTS THAT YOU MIGHT BE INTERESTED IN

MiraltaBank

Narval

Information

A unique equity investment fund. Designed for the long term and specialising in quality companies.

More information

MiraltaBank

Pulsar I

Information

Our hedge fund (HF), a solution to the complex fixed-income investment scenario

More information

MiraltaBank

Pulsar II

Information

New free investment fund (FIL) designed as a strategic solution for both investors and companies.

More information

Ignacio Fuertes Aguirre

Ingeniero de formación

Ignacio cuenta con 20 años de experiencia en mercado de capitales y trading. Ignacio comenzó su carrera en Merrill Lynch en Londres.

Más tarde, formó parte de Vega Asset Management como responsable de ejecución y trader del fondo Vega Global. Antes de fundar Rentamarkets (ahora Miraltabank), fue gestor en la gestora de fondos de gestión alternativa Próxima Alfa.